Post-pandemic Recovery

As summer comes into full swing, tourism is set to return to pre-pandemic levels. As a result of rebound tourism, a substantial surge in outdoor activities and travel is expected. While domestic travel has been most popular, international travel is predicted to pick up this year with covid restrictions easing. During the months of June to August, many consumers will seek pleasure in international travelling. This will apply to Chinese consumers in particular they make up a big part of the tourism market.

Current market situation

In 2020, no industry was hit as hard by Covid-19 as the travel and tourism market. There was a drop of 72.4% in global international tourist arrivals from 2019 and an 89% drop in business travel. 62 million people lost their jobs in the tourism and travel sector (dream big travel far blog). The Asia and the Pacific regions experienced the lowest drop in tourist arrivals of 90% with places like Hong Kong having a 100% drop in comparison with 2019.

As of October 2022, Canada is fully open in terms of travel restrictions and with no separate requirement for travellers from China. Proof of vaccinations, quarantine, health checks, pre-entry and arrival tests are no longer required. These relaxed restrictions combined with restored flight routes are encouraging international travel. Travel Industry players in North America should take advantage of this timing of rebound to increase their business opportunities from the Chinese consumers through correct cultural-focused marketing strategies.

Travel Trends of 2023

- A rise in international travel has been undeniable as the number of air passengers rose by approximately 47% in 2022 compared with 2021 and will only continue to rise (ICAO). Searches on Kayak for flights abroad are up by 1.3% versus a year ago, according to data as of December 18. Whereas searches for domestic flights were down by 13%. It will be hard to predict just how high the demand for summer travel will be so travel companies will need to look deeply into insights to optimize pricing.

- Older travellers have been reported to be most cautious of covid outbreaks and expected to spend less on travel. So, markets are best to target younger age groups. Additionally, investing in messaging and advertising which dispels concerns about safety as well as the weather will be beneficial.

- There will be a higher demand for flexible tickets as more people are booking trips last minute compared to pre-pandemic times. Instead of the typical times of booking 6 to 8 weeks ahead for domestic flights, people are tending to book only 3 to 4 weeks in advance (Town and Country Today). The shoulder seasons around the summer, late spring and early fall seem to be the most popular times.

- The hottest destination for travel this year has been Asia. According to the data from the U.S. government agency, International Trade Administration, the biggest change has been in departures to Asia with an amazing 380% increase between January 2022 and January 2023. It’s a shift that will continue, if not accelerate into the summer.

Understanding Chinese Consumers' Attitudes to Post-pandemic Travel

The pandemic has changed the tourism environment drastically, from destinations to costs, but one thing that remains unchanged is people’s desire to travel. This is particularly true for Chinese tourists, who have always been keen on leisure travel. In fact, leisure was the biggest driver of China’s outbound travel representing 65% of travellers in 2019. Additionally, 6% of Chinese tourists journeyed to visit friends and relatives while 29% did so for business purposes.

In November 2022, the Survey of Chinese Tourist Attitudes published by McKinsey & Company showed that 40% of respondents still planned to participate in outbound travel for their next leisure trip.

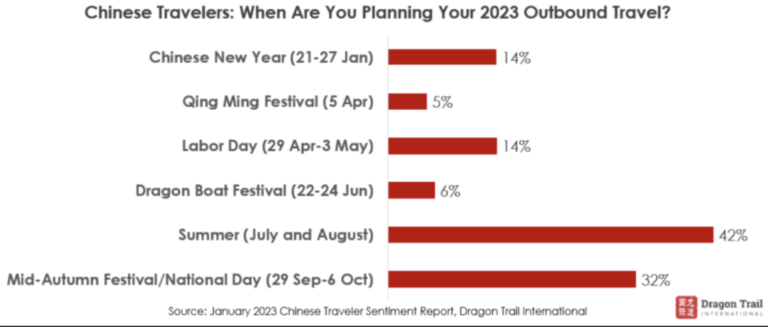

As of January 2023, the outlook for outbound travelling has become more promising. According to the Chinese Traveler Sentiment report published by Dragon Tail Research, more than 60% of their survey respondents said they had plans for outbound travel. Specifically, “42% plan to travel in July and August, with 32% planning cross-border trips for the Mid-Autumn Festival and National Day Golden Week holiday from September 29th to October 6th” (Dragon Tail International). Chinese tourists aren’t slow in embracing travel trends; hence Asia will still be the most popular destination, with Hong Kong, Macao and Thailand being their top choices.

With the previous travel trends of domestic travel in 2021 and 2022, people have realized the opportunities and beauty of destinations relatively near them. As reported by Dragon Tail Research, the remaining 39.4% of their survey participants leaned towards domestic travel. For Chinese immigrants in North America, it means capitalizing on their interests (according to Destination Canada) on activities such as the northern lights and camping.

Chinese migrants in North America can be viewed as ‘transplanted consumers’ as they maintain the same consumer values before they are completely acculturated, so their attitudes towards travel will still be very similar after they move to North America.

The utilization of social media by travel businesses has become a necessity in attracting customers. And has become the most effective way to advertise.

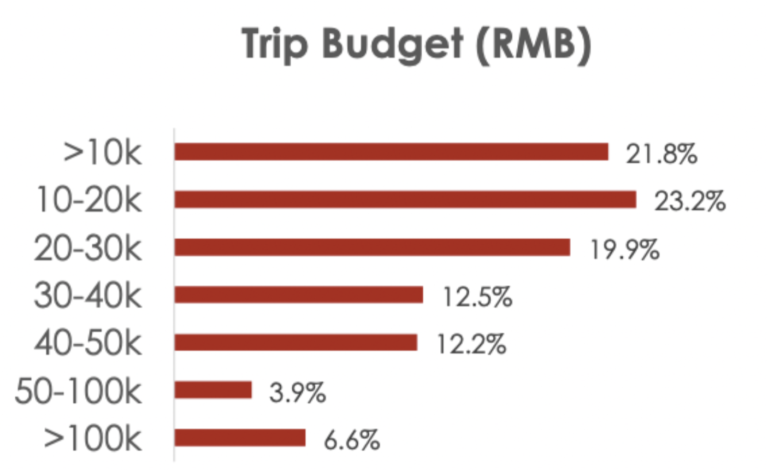

Chinese Tourists' Spending Power

According to Destination British Columbia, mainland Chinese visitors to Canada have had a reputation for spending more capital than visitors from any other nation. As predicted by Dragon Tail Research, “2023’s typical Chinese outbound trip will be with family, for 5-10 days and cost within RMB30,000”. Chinese travellers pay attention to cost but do not simply seek out the cheapest prices. The wave 6 attitude survey from McKinsey & Company showed that 17% of the participants were concerned about low prices, 33% are on the hunt for value-for-money promotions, and 30% prefer good discounts and worthwhile deals.

How to Target the Hungry Chinese Travelers

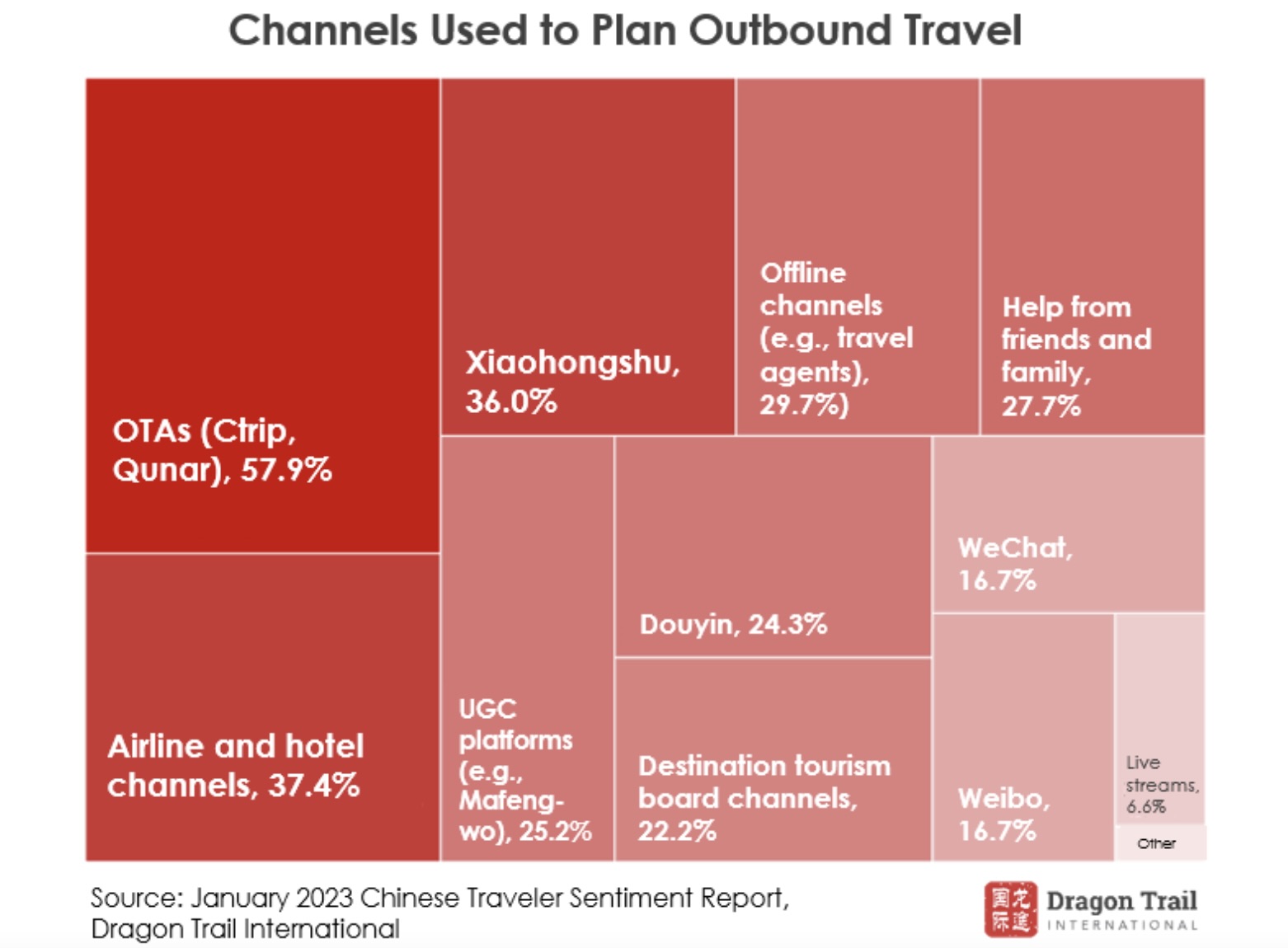

The leading tool for outbound travel advertisements has been online travel agencies like Ctrip and Qunar but Xiahongshu, also known as the Little Red Book or Red has greatly and positively impacted the tourism and travel sector. Showing just how influential social media platforms have been in providing travel inspiration as well as assisting in planning.

This is why it is crucial to leverage Chinese Social Media content marketing strategies to present important values and detailed information about your different products and services through popular KOL (Influencer) platform.

A well-planned Chinese programmatic ad campaign can reach the Chinese audience in North America through their favourite and most visited Chinese websites, mobile apps, and streaming platforms, and target them with interest and browsing history of travel related content.

Reaching Chinese Consumers in North America

The post-pandemic Summer of 2023 is the ideal time to create an impactful online presence for your brand in front of the Chinese audience in North America.

Unsurprisingly, family travel will be by far the strongest sector. Hence, family-oriented services and products such as those appealing to married couples, families with children and elderly parents will best meet market demands.

Interested in learning more? Connect with us today.