The potential of Chinese Consumers market should not be overlooked in the Insurance & Financial sector in North America.

Chinese immigrants arrive in Canada or the U.S have bigger needs than regular North Americans do on advice in insurance, estate planning and investing for goals such as home buying, children’s education as well as wealth maintaining and building. They usually carry with them relatively larger amounts of cash for the short-term and long-term needs that will arise as they develop their new lives in the new country.

These newcomers might also have unique needs, such as specialized tax planning involving foreign assets or the hurdles that their credit history isn’t recognized in North America. And a high proportion of immigrants also own businesses, which comes with a variety of other financial considerations.

Transplanted consumers from the Huge Insurance market in China

The Chinese insurance industry has experienced rapid expansion over the past decade. China (with total annual premium income of 0.63 trillion in 2019) is now the world’s second-largest insurance market after the United States. (Source: CBIRC, Fitch Solutions, Deloitte Internal database). It is also expected to surpass the U.S. to become the world’s largest insurance market in the mid-2030s, as per a report from Swiss Re Institute.

According to the 2021 Insurance 100 Ranking of the world’s largest Insurance companies conducted by Brand Finance, three of the Chinese biggest insurance brands, Ping An, China Life & CPIC, were within the top 5. And 12 Chinese brands in the ranking account for 30% of total brand value as brands leverage significant volume premium of Chinese market.

The continues growing insurance market in China reflects that people from China are very accepting to the concept of insurance and they have high intention to buy. Chinese Newcomers to North America can be perceived as ‘transplanted consumers’ from the China market, they retain the same consumer values with them to the new country, making them a big potential market for Insurance and Financial Companies.

Relatively new Chinese immigrants who go through more stringent immigration rules to get into Canada and the U.S. are generally more affluent, they see the need for quality financial service providers to arrange their assets as well as insurance policies which fit the situations of their new life in North America.

Also, family legacy is a very important value in the Chinese culture. They tend to pass as much of their assets as possible onto their next generations. Insurance and financial planning fits well into this need by providing them with the best wealth arrangement solutions which last for generations.

In the past two decades, Foreign Insurance Companies like Prudential, Manulife & Sunlife have been actively expanding their business into China. And as China further eased market access restrictions on foreign insurance companies in 2019, we expect the trend will speed up and people in China will get to know more North American Insurance brands. So, it becomes more important for brands to understand Chinese Newcomers and market to them as early as possible to stay competitive.

What determines Chinese Consumers’ decision to buy?

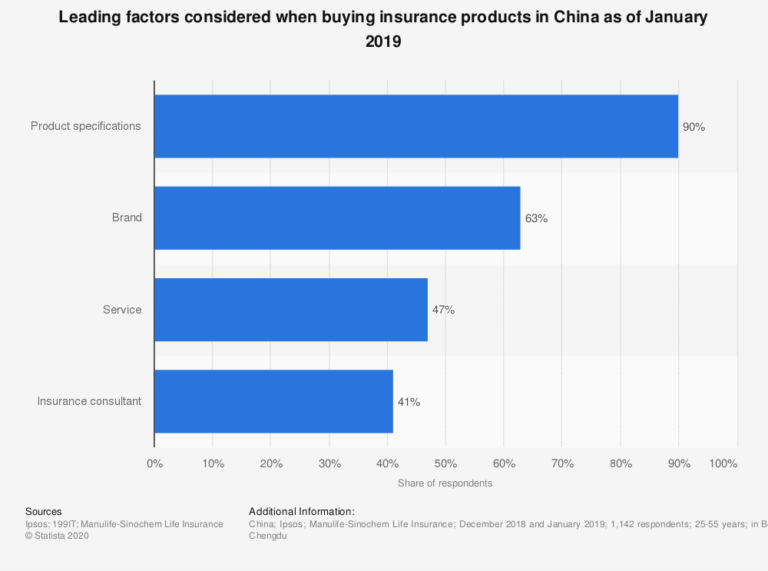

According to a 2019 survey on the leading factors considered when buying insurance products in China conducted by IPSOS and Manulife Sino-Chem, the most important factor is Product Specifications, Chinese consumers tend to actively look for detailed information about the products as well as the offerings and do comparisons based on this information before they make the buying decision.

The second most important factor is Brand followed by Service and Insurance Consultant.

Most of them probably purchased their Insurance plans from the Chinese brands back in their home country. But when they moved to North America, those familiar brands are no longer available as options. They will be exposed to a totally different line-up of choices in North American brands from which they will look for those they perceive to be reputable and strong.

We looked around and see the Chinese immigrants discuss a lot in their social media about buying Insurance products and some of the other important considerations other than the above. We also found that their general perceptions are that Insurance products in North America offer better advantages on those features over China.

To see the complete list of these important considerations and more about Chinese Consumers’ behaviour in purchase of Insurance and Financial products, email us today at psiu@glaciermedia.ca or directly book a meeting with us.

Deterministic Strategy is the key

In order to more effectively tap into this potential market at the best timing, Insurance & Financial brands should create a Top-of-Mind Awareness with deterministic targeting strategies which focus on the Chinese Newcomers (been in North America for less than 5 years) & Establishers (been in North America for 5 to 15 years).

These segments of Chinese consumers:

- are in the stage with the biggest needs and highest buying intension for Insurance & Financial products

- retain most of their original consumer values developed back in China

- retain most of their media usage habits. They still spend most of their time visiting their favorite Chinese websites, mobile apps, and video streaming platforms while living in their new environments. These popular China-based platforms are not accessible through the general open exchange.

At Eastward, we reach these consumer segments through our unique Chinese programmatic ad platform that unifies the display, video, and native inventories from top Chinese publishers and walled gardens.

Content marketing strategies on WeChat and Weibo can also be added to deliver the product and service specifications in a native way so that Chinese Newcomers & Establishers will have more information to consider your brand over others for their needs in Insurance and financial services in Canada.

Interested in learning more? Connect with us today.